May 2024 By-Law Changes

Common bond opening

CareCoop endeavours to be a true wealth builder and in doing so, changes have been implemented to address some challenges among others being;

- The continuation of the main member’s legacy in an unfortunate demise of main member

- Inclusion of younger generation amidst aging membership concerns (sustaining operations)

- Progressive and organic growth of CareCoop membership

Common bond entails:

- Immediate family of main member will now be members of CareCoop

- These include, spouse and children of main member (biological or legally adopted children)

- Members above 18 will be allowed to borrow while below 18 will be savers only

- Members below the age of 18 years will be allowed to have accounts opened for them in trust

- Upon attainment of age 18, members transition and become eligible to borrow

- Only members who have been with CareCoop for a period not less than 12 months and have been consistent with their savings contributions/loan repayments for that period shall be eligible to enlist their immediate family member(s) as secondary members.

- Secondary members shall require their loans to be fully guaranteed in the first 5 years of their joining membership beyond which period they will be transitioned into primary members with all benefits of primary membership accruing to them.

- Ts & Cs shall apply

Mandatory shareholding as it Relates to Compliance

To fully comply with principles of Co-operatives and enhance member participation, below implementation has been made;

- Mandatory shareholding for all members

- This will enhance value proposition for all members as there will be common purpose

- Will make CareCoop compliant with Cooperative management requirement

- Changes are as follows:

- All non shareholders shall be allotted 5 shares equivalent to ZMW 2, 710 across the board

- All shareholders with less than 5 shares to be allotted additional shares to comply with requirement of 5 minimum shares (at ZMW 542 per share)

- Share allotment options will include, savings deduction, share financing loan, contribution up to 9 months (All to be compliant by December 2024)

- The initial allotment will be done as a deduction from individual savings accounts for all members whose shares are below the minimum of 5 shares. For members with completely no shares, CareCoop will deduct the equivalent of 5 shares at the current share prices of ZMW542.00 per share which totals ZMW2,710.00.

- All new onboards are now required to purchase minimum 5 shares and varying options will be given

- Minors are exempted from mandatory shareholding

Long Term Savings

To adequately support the strategic direction of CareCoop, there is need to;

- Grow institutional capital

- Align contributions to reflect the growth trajectory, considering no increase the past 5 years

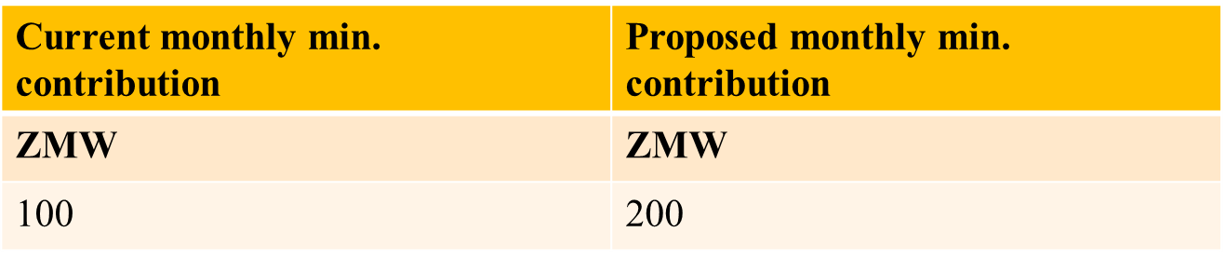

Below table shows actual increase:

Where ZMW 100 is posted to ordinary savings, and ZMW 100 is posted to long term savings, withdrawable only upon member exit All savings contributions will receive interest with long term savings receiving higher interest

Tandizo Benevolent Fund

The Cooperative shall maintain a Tandizo Benevolent Fund known as “TANDIZO BENEVOLENT FUND”. Membership to the fund shall be compulsory for all members of CareCoop. The objective of the Fund is to raise and maintain funds for the purpose of assisting family members in meeting burial expenses upon the contributor’s demise and assist contributing members get an honourable burial.

The major source of income for the Fund shall be annual contributions by members. Annual contributions shall be paid through a mandatory debit on withdrawable savings accounts at the beginning of the year. Members shall make an annual contribution subject to a minimum amount set by the Board at any given point in time.

AIMS AND OBJECTIVES

- Assist family members in meeting burial expenses upon the contributor’s demise.

- Assist contributing members get an honourable burial.

MEMBERSHIP

- Membership to the fund shall be compulsory for all members of CareCoop.

- Annual contributions shall be ZMW200/= paid through a mandatory debit on all savings accounts at the beginning of the year.

- For all existing members, this is mandatory and will not require application.

BENEFIT

- ZMW12, 000.00 once off benefit